Once you realize that most of your consumers hold your storefront in their hands, you can accept the importance of M-Commerce.

Mobile commerce (M-Commerce) is a type of e-commerce that uses mobile devices rather than computers for purchasing and selling products and services. Cell phones and other digital devices created the idea of M-Commerce and smartphones and other mobile devices like tablets, have sped up the development of this market of products and services.

Examples of M-Commerce

Of course, the traditional e-commerce examples are the foundation of what M-Commerce is about. Other transactions outside of these traditional ones are considered part of M-Commerce.

Here’s the type of transactions that are considered M-Commerce:

Online Shopping

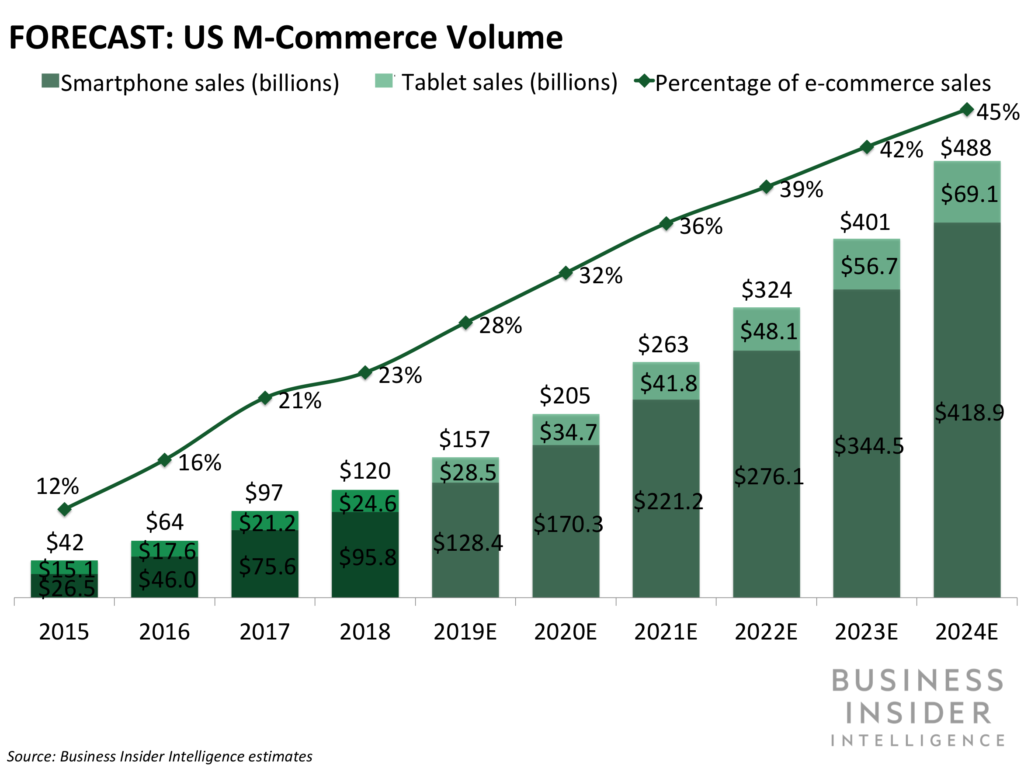

Shopping online continues to dominate the M-Commerce space with numbers of purchases made on mobile devices expected to more than double in the next four years from $170B to a whopping $418B via the Business Insider (graphic above). Nearly every mobile phone has been used to purchase something online. Much of the M-Commerce growth comes from this area. In fact, Statista says that: “In 2021, 72.9 percent of all retail e-commerce is expected to be generated via m-commerce, up from 58.9 percent in 2017. Emerging e-commerce markets in mobile-first economies are a large driver of this trend.”

Mobile Offers

More and more customers are feeling more comfortable in purchasing from their mobile device and brands are making digital and mobile centric coupons part of their marketing mix. By 2022, mobile will account for 80% of coupons redemption (Juniper Research)

Mobile Banking

Believe it or not, mobile banking is a considered M-Commerce. As financial institutions understand the importance of online banking, their significance to M-Commerce grows. Being able to make financial transactions quick, easy and safely online is what customers have come to expect.

Since anything online is always open, bank customers can make transactions any day or any time. This convenience and the decreased need of physically making any transaction at a bank has increased bank customers’ experiences and helped the banks save money.

Mobile banking continues to grow and its importance has become staggering. Fortunl reports that nearly 9 out of 10 U.S. (89%) bank accounts use mobile devices to oversee their account.

Mobile Payments

I know what you’re thinking, what’s the difference between mobile banking and mobile payments? The difference is that mobile payments are when you pay for something using your mobile device. In this case, the mobile device acts as a credit card or check. You can physically use your device at checkout or pay for your goods through a digital platform.

Many consider that mobile payments actually have the most upside when it comes to M-Commerce. Besides calling, texting, emailing and searching, your phone is now a form of payment. Your phone may make credit cards obsolete.

Even with the upside, mobile payments continue to have some challenges, including consumers’ reliance and loyalty to traditional ways to pay. Plus, not all store owners accept this as a way to pay. However, as programs that encourage loyalty proliferate the business landscape, turning to mobile payments appears to be a natural fit.

Since mobile devices aren’t losing popularity, M-Commerce will continue to grow and have a greater influence in our lives. It will continue to make shopping easier, both online and in stores, through shopping apps, mobile banking and ways to pay for everything.

Having a mobile presence is more important now than ever. Having tools such as mobile coupons or targeting your display advertising for mobile consumption could be a difference maker for your own business growth. Learn more about how Thumbvista can help today.